Sequoia's "Adapting to Endure" Presentation: The Future of Tech

Published:This year hasn't exactly gotten off to a roaring start for tech companies. So far the NASDAQ is down ~25%, which actually belies the level of wealth destruction that's occurred for the most growth oriented names (i.e., pandemic darlings like Zoom are down ~42% YTD and ~70% from their peak).

Last week Sequoia - one of the oldest and most prominent venture capital funds - put out a presentation titled "Adapting to Endure". While it's not abnormal for VC funds to put out presentations - or to make obnoxious twitter threads - this is a bit different.

Sequoia put out similar presentations during the depths of the Great Financial Crisis and during the onset of the pandemic in 2020. These presentations have always had a dual function: laying out why we're here and how companies should pivot.

Also, unlike past presentations, the leaked Sequoia presentation has lengthy footnotes to accompany the slides, which is helpful for getting a better understanding of their thinking.

Table of Contents

This is a bit of a longer post than we intended. However, given the volatility in the tech space over the past number of months we decided to spend a bit more time breaking down Sequoia's presentation.

Why What Sequoia is Saying Matters

Why Sequoia Believes We're at a Crucible Moment

What Sequoia Believes this Means for Funding

What This Means for Technology Investment Banking

Why What Sequoia is Saying Matters

Like most VC funds, Sequoia is focused on funding early-stage high-growth companies that have little or even no revenue.

Given how much public high-growth companies have had their valuations slaughtered this year, it wouldn't have been surprising to see them come out with a presentation that said, "We've all benefited from some irrational exuberance in markets over the past few years. Now things are beginning to normalize and maybe even over-correct a bit. But don't worry -- just stick to what you're doing and be disciplined with your cash management."

However, what the presentation actually says has taken many (ourselves included!) by surprise. It paints a much more ominous portrait of current market conditions, and where they envision things going moving forward.

This obviously isn't to say that Sequoia is going to be right. But when a large VC fund - that has seen many ups and downs in the tech world - says that we're at a "crucible moment", then it's important to understand what's behind their thinking.

Further, even if you don't agree with them about where we are today and where we're going moving forward, how Sequoia is advising those they've invested in does affect how companies position themselves and eventually permeate through the pipeline at the investment banking level (when it comes not only to IPOs, but also general M&A activity).

Why Sequoia Believes We're at a Crucible Moment

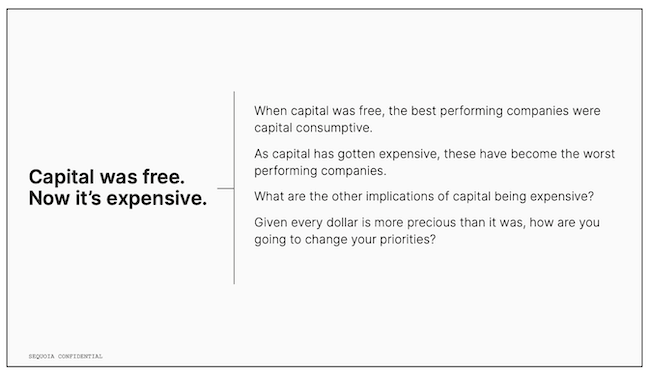

The crux of Sequoia's argument centers around the cost of capital. This isn't too surprising given that, obviously, when you have an absurdly low discount rate that makes companies with high-growth and large future free cash flows (far into the future) more valuable.

Note: This is why some who are more pessimistic say that much of the success of venture capital over the past few decades involves just taking advantage of rates that have slowly ground down to extremely low levels, alongside an industry that has had across-the-board valuation multiple increases. In other words, high-growth tech companies are just an extremely risk-sensitive asset class that has benefited for decades from rates that have been kept extremely low (often negative in real terms).

Anyway, Sequoia is indirectly making the argument that we're going through a "shock and awe" style price readjustment in tech because of how rapidly rate hikes have been priced in (as you can see when looking at forward rate expectations, which have 10x'ed over the past nine months).

So, why does any of this really matter? Why is Sequoia telling the companies they've invested in to prepare for incredibly tough times ahead, despite the fact that the market is just pricing in the Fed reaching a pretty modest (historically) Fed Funds rate?

Well, certainly you could argue that in order to cool inflationary pressures the Fed needs to introduce more slack into the labor force, which would create sufficient demand destruction to cool inflation. This could have the (unintended) consequence of causing a recession (since raising rates is a blunt tool) which could then negatively impact the growth prospects of high-growth companies that have their valuations underpinned by achieving rapid growth.

However, the argument Sequoia is really making is that not only has money been absurdly cheap since the Great Financial Crisis - with a modest increase in 2018-19, which did cause tech equities to sell off significantly at the time - but also folks were must more likely to fund companies because of how high tech valuations were (because of how low the discount rate was, as already discussed).

In other words, Sequoia is not saying that future funding will be hard to come by due to slower growth in the economy, but is rather making an argument surrounding cost of capital increasing and, as a consequence, valuations declining.

So, in other words: over the past decade money was cheap and the valuations of high-growth tech companies were extraordinarily high. Which meant, obviously, that investors thought their returns would be extraordinarily high from funding a diverse array of these companies. However, today money is getting more expensive and valuations for high-growth tech companies have compressed.

To illustrate this point and how quickly sentiment has changed, just eighteen months ago Zoom had a larger market cap than Exxon and today Exxon has a 10x larger market cap than Zoom.

What Sequoia Believes this Means for Funding

If you scroll down toward the end of the presentation - when you get beyond Sequoia's discussion of the macro and funding environments - you get to the heart of their advice to companies: conserve cash and start generating free cash flow.

Put another way, Sequoia is telling the companies they've invested in that they shouldn't expect to go raise debt or equity on a whim at favorable terms.

This is obviously a large change compared to what we've observed over the past decade with the exception of a very brief blip during March and April of 2020.

However, the reason for this change is two-fold...

First, because of the beating that many tech companies have taken in the public markets, it shouldn't be the expectation of high-growth companies that they can go and do an IPO to raise cash and then continue to burn it as they prioritize growth over profits. To solidify this point, Sequoia put in a few slides illustrating that today the market is valuing free cash flows above all else:

Second, one of the largest new sources of funding for private companies over the past few years have been hedge funds (i.e., Tiger Global) that have tried to get into as many rounds as possible for as diverse an array of high-growth companies as possible. While this worked very well for a number of years, these hedge funds have suffered extremely large loses so far this year and have heavily curtailed their participation in new funding rounds (i.e., Tiger Global is down over 50% YTD).

So, what Sequoia is really saying is that funding is going to be much more sparse moving forward and that funding will likely only be available to those companies that have strong cash flows and are just looking for new cash to continue to (profitably) grow.

This is a good point, and the one we'd agree with the most. Because traditionally when funding has dried up over the past three decades it's been because of a large downturn in the economy. When this has occurred inflation has normally been below target and so the Fed has responded by lowering rates and potentially doing QE to inject liquidity into the system.

However, we're in a fundamentally different dynamic now because our issue isn't severely contracting economic growth, but rather exceedingly high inflation, which can only be combatted by a central bank through raising rates (thus making the cost of capital more expensive).

So, unless we get a sharp economic contraction that's paired with inflation quickly falling down, the Fed won't be swooping in to lower rates any time soon. This means that the era of obscenely cheap money is, for the foreseeable future, gone.

What This Means for Technology Investment Banking

Sequoia paints a rather bleak picture. But keep in mind that this is their description of the present and their projection of the future. Further, Sequoia is operating at the beginning of the pipeline - funding new and novel companies that are often pre-revenue or undergoing massive growth while burning cash - whereas investment banking sits largely at the end of the pipeline.

As we mentioned in our last post on group placement interview questions, just because the private and public markets are undergoing a price correction doesn't mean there won't be investment banking activity. For example, there will still be relatively healthy companies in the tech space that want to IPO to give their investors and their employees exit liquidity (although IPO activity has certainly slowed considerably, and likely will continue to be quiet).

Further, with so many promising tech companies trading at such severe discounts, tech-focused private equity funds that have undergone massive fundraising over the past few years will be circling for deals. This will also be the case for larger strategic acquirers who suddenly see value in these companies (even if it's just to get their intellectual property or to acqui-hire their employees).

While growing equity markets are generally a leading indicator of deal activity, when you have sharp market corrections it doesn't mean that deal activity entirely dries up. Rather, it means the composition of acquirers changes (along with their rationale for making an acquisition).

So while tough times are likely ahead for venture-backed companies - even if it's not quite as ominous as Sequoia is suggesting - that doesn't mean that technology banking will go through similarly tough times. However, given the record-breaking pace of deal making we saw over the past two years, it's only natural to anticipate a pull back in deal activity (since you can't set records every year indefinitely).

Summary

As mentioned earlier, when Sequoia's presentation was leaked last week it reverberated quite loudly across the industry because it showed that they believe we aren't just in a brief correction, but rather are in an entirely new paradigm when it comes to high-growth tech companies.

In this post we've tried to add in some details giving our explanation for what Sequoia is really thinking (i.e., why the cost of capital and valuation compression will have such an impact).

As we've written about in prior posts, it's important to disentangle where the private or public markets are at any given moment with actual deal activity. While there's undoubtably a correlation, you have to think about what acquirers are out there, what their incentives are, and how much capital they have to deploy if presented with the right opportunity.

For these reasons, we think that while tech banking activity will pull back - as it already has to begin the year - but that it will remain one of the strongest coverage groups in 2022 and 2023 (perhaps coming in second after FIG).

Finally, it's also important to keep in mind that just because you may enter into tech banking during a quieter deal environment, that doesn't mean that you won't still have great exit opportunities when you want to leave banking. Everything is cyclical, and if you are truly interested in technology you shouldn't be looking to pivot to what you perceive will be a hotter coverage group in the years to come.

If you're currently going through the interview process, or are getting ready to do so, be sure to check out the technology investment banking interview questions and TMT investment banking primer we put together. If you're looking for something even more comprehensive, then there are the TMT interview guides as well.